this is usually done with some suitable linear regression: form a new time series, which is the difference of the two.Here, we test if linear combination of and is stationary. Granger 2-step Causality TestĪ classic co-integration test is the 2-step Granger test. Instead, we propose a relationship between and, such thatĪnother way of saying this, which might be more familiar to Machine Learning practitioners, is that we say causes when the future values of can be better predicted with the histories of both and than just alone. If we naively regress against , we might find a correlation when none exists. We then ask what causes ? Or, rather, if we have another time series, we ask Where is any linear or possibly non-linear relationship. Usually we see this expressed as the linear relationshipĪlthough we can express this more generally,

CAUSALITY AND CORRELATION SERIES

Say we have a time series such that depends on all previous values of. Granger and Engle developed a simple test for this. Or, more technically, 2 (or more) time series are co-integrated if they share a common stochastic drift. So how does one define –and test–for co-integration?Īny 2 time series are co-integrated if any linear combination of them is stationary

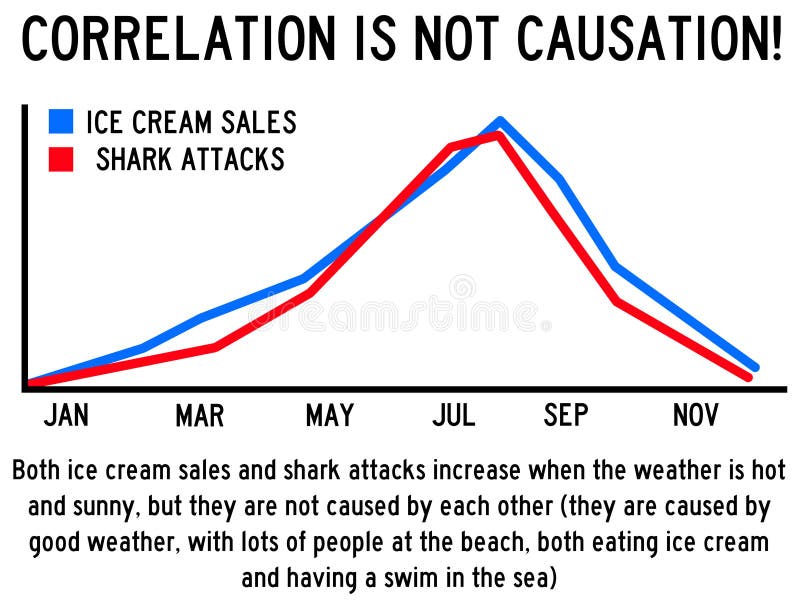

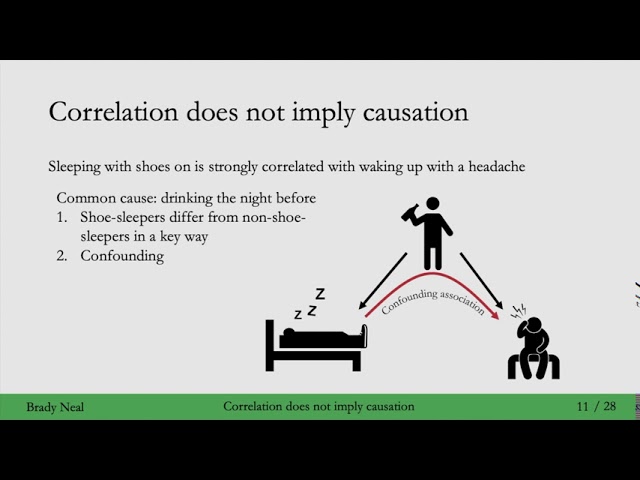

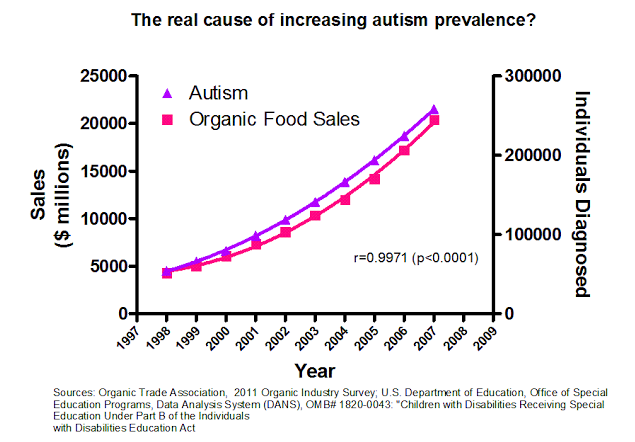

The success of Pairs Trading has stimulated the search for sophisticated tests for co-integration. One selects 2 assets that stay close to each other over time enough that they can be successfully traded. Instead we say the 2 paths are Co-Integrated.Ĭo-Integration is particularly useful in Pairs Trading Pairs Trading Both the drunk and her dog follow a random path, but they still try to stay close to each other. That is:Ī classic example is to look at a drunk walking her dog. In particular, they developed simple tests to determine if one time series is being caused by another time series –even when they not correlated. Granger (UC San Diego) won the Nobel Prize in Economics for their development of Statistical Methods for Economic Time Series. See also the Kaggle contest below Granger Causality and Co-Integration , both as a practical tool, and within the context of modern machine learning. If time permits, we will also look at some more recent methods, such as the the Thermal Optimal Path Method developed by Sornette et. see a new test of Granger Causality that, in theory, should work much better in time series dominated by noise.establish a deep relationship between Granger Causality and the Fluctuation-Dissipation Theorem, and.In this series of posts, we review a very interesting paper that came out a few fears ago that establishes the relationship between Econometric notions Causality and the Mori & Zwanzig Projection operator formalism of non-Equilibrium statistical mechanics. Be it finding simple models for the Brownian motion of particles floating in water, or wrapping our heads around highly non-equilibrium systems that appear to be dominated by random fluctuations. In Chemical Physics, noise abounds, and we have to deal with it explicitly. Here, we really need to understand the ’cause’ of the pattern because most financial time series are highly non-stationary and it is quite easy to overtrain just about any model - and lose all our money. on Wall Street - we seek patterns in noisy time series–patterns we can trade. Could we find a Gravity Wave or predict an Earthquake by observing a specific non-linear pattern–or did we just have noise? In a previous post, we looked for specific non-linear models of signals in very noisy data, such as gravity waves and earth quake prediction. We seek practical methods that can detect a weak signal in noisy time series – – and model the underlying ’cause’ Science: the Search for Causation In our continuing studies of noisy time series, we do not seek to address “the fundamental philosophical and epistemological question of real causality,” but, rather, This is especially true in financial and econmetric time series, which do not seem to follow any of the simple laws of statistics. It is certainly true, however, that if we are naive, we can fool ourselves into seeing patterns that are not really there. After all, the entire point of science is to measure correlations and other signals and determine models that explain their cause and can predict future events.

CAUSALITY AND CORRELATION HOW TO

When faced with this statement, I’m never really sure how to respond.

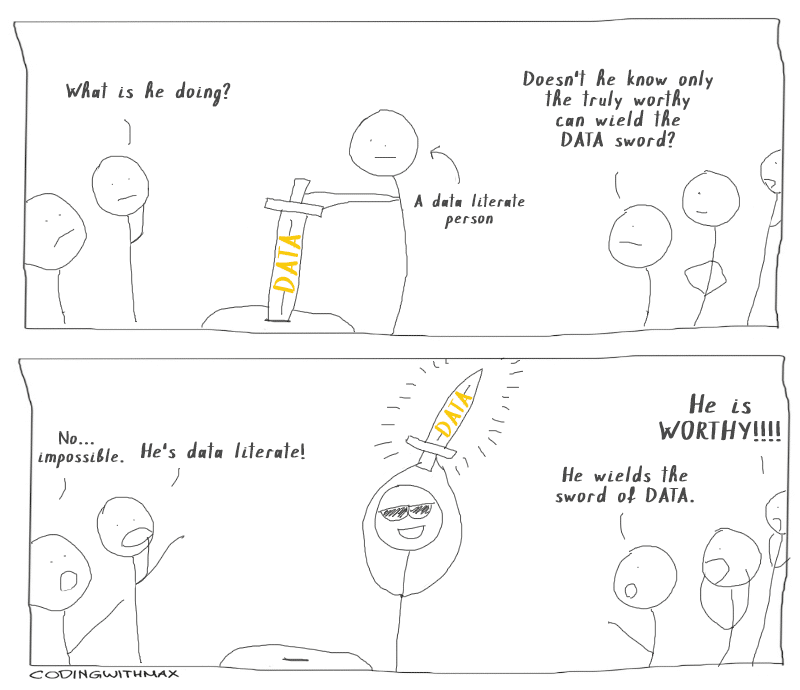

One of the most repeated mantra’s of Machine Learning is that

0 kommentar(er)

0 kommentar(er)